Share of Search (SoS) is arguably one of the most vital, yet frequently underutilised, indicators of a brand's health.

SoS quantifies your brand's proportion of online searches relative to competitors within a specific category, making it a powerful, real-time proxy for awareness and consideration of a brand.

the evidence and adoption

The significance of SoS rose to prominence around 2021 when leading marketing effectiveness experts, notably Les Binet, provided compelling evidence that SoS is a leading indicator of future market share. This research demonstrated that changes in branded search volume can accurately predict subsequent changes in sales, typically exhibiting a lead time of approximately six months.

Recently, Adidas has validated this metric by adopting SoS as a core brand health KPI. It was chosen due to being a cheap and efficient lagging indicator of revenue and market share fluctuations across 38 countries, favouring it over more traditional metrics such as NPS.

What makes SoS so appealing?

The beauty of SoS lies in its attainability, cost and frequency at which it can be obtained.

Brand trackers (whilst very effective at tracking changes in brand perception) are expensive, time-consuming, and are usually not effective indicators of changes in market share amongst brands. In contrast, the data acquired for monitoring SoS is free, easy to obtain and correlates strongly with future revenue changes.

This guide outlines a five-step process for obtaining a preliminary view of your brand's Share of Search against key competitors.

Five steps to calculate SoS

Step 1: Select a search volume tool

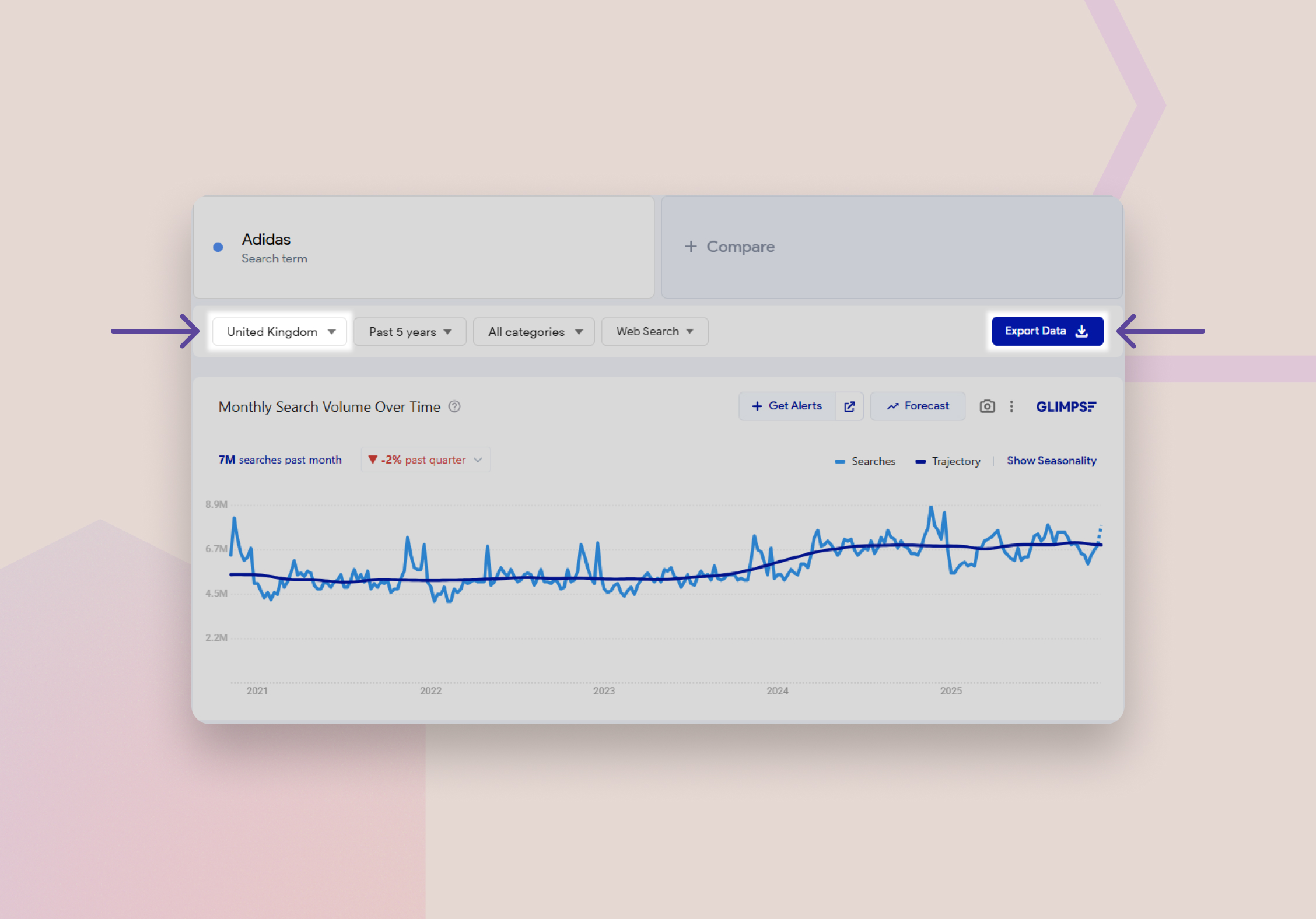

To begin, you must utilise a tool that provides absolute search volume data. Google Keyword Planner is free and simple to use. I tend to use Google Trends, however, a plugin like Glimpse is required to obtain absolute search volumes. You can also use tools like Ahrefs and Semrush.

Step 2: Identify core category competitors

Accurately defining your competitive set is critical. This step requires a thorough understanding of the core players within your category. The process is simpler for brands operating in niche categories.

Step 3: Acquire historical search data

Retrieve the historical branded search volumes for each identified brand. Consolidate and populate this data within a structured spreadsheet for analysis. Make sure when you’re searching for the brands that you’re filtering the location to your desired region (e.g. UK, France, USA etc).

Step 4: Calculate Share of Search

Convert the raw search volumes into a percentage share using this formula.

Step 5: Analysis and ongoing cadence

Establish a regular cadence for updating and analysing the data, typically quarterly, though a monthly measurement may be appropriate for more dynamic categories. SoS should be analysed against sales volumes to determine the specific correlation for your brand. This calibration process may take several reporting cycles, as SoS functions as a leading indicator. Furthermore, SoS can be used in conjunction with, or in isolation from, traditional brand tracking data.

Strategic application of Share of Search

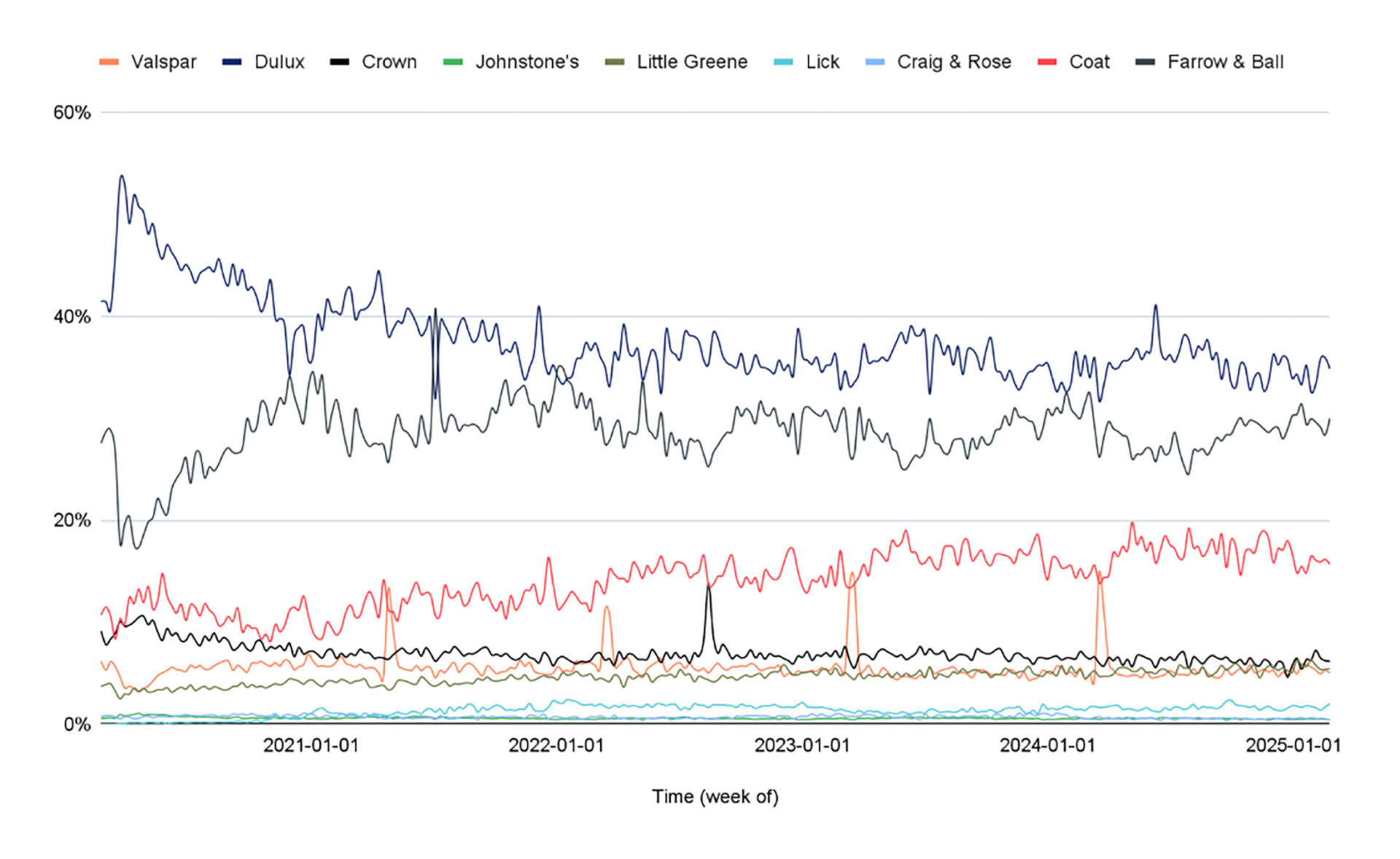

The primary use of SoS is as an indicator of brand health and future sales potential. An upward trend in your SoS should ideally align with brand awareness and marketing effectiveness initiatives.

SoS also serves as a vital competitor intelligence tool. Monitoring significant spikes in competitor SoS likely signifies an uplift in their media spend, a major campaign launch, or a strong promotional push. This metric, therefore, provides critical insight, informing which competitors warrant deeper review of their marketing activity.

Limitations and considerations

While powerful, SoS is subject to certain limitations that must be managed for accurate measurement:

- Branded search term accuracy: The model is challenged when brand names overlap with common nouns or other brands (e.g., "Apple" the brand vs. "apple" the fruit). This term ambiguity can lead to an inaccurate reading of true branded search volumes. SoS tends to be most reliable for brands with unique or niche naming conventions.

- Data collection efficiency: Manually compiling and cleaning this data can be time-consuming, particularly across numerous competitors or when measured at a high frequency. For large-scale or frequent analysis, automation is highly recommended. This typically involves using an API to pull data directly into visualisation platforms such as Power BI or Looker.

Share of Search (SoS) is not just another metric; it represents a fundamental shift in how we measure brand health and forecast future performance. Yet it still feels underutilised by many brands we work with.

Implementing the five-step process outlined in this guide empowers you to move beyond speculation and gain actionable, data-driven intelligence on your competitive position. As you establish your ongoing measurement cadence, SoS will serve as an essential measure of your brand's help, guiding strategic marketing decisions and providing early warnings of shifts in the competitive landscape.

WANT TO PUT SHARE OF SEARCH TO WORK FOR YOUR BRAND?

Whether you're building your first model or scaling an automated measurement system, our team can guide you through every step.

If you’re looking for a more confident, data-driven view of brand health, let’s talk, we’d love to chat.

Ready. Steady. Grow!

We've helped some of the world's biggest brands transform and grow their businesses. And yours could be next.

So if you've got a business challenge to solve or a brief to answer, we'd love to hear from you. Simply complete this form and one of our experts will be in touch!